As a pure investment farm land has extensively provided constant gains, especially as food prices have climbed. In line with the Farmland Index produced by the National Council of Real Estate Investment.

The vast majority of Investors take into account land is a safe place to park money.

Ranches have always had a spot inside a wealthy investor’s portfolio.

Ranch life taps in to the American desire to have space, freedom and a connection with the land. Lately, owning a ranch, and selling the products raised on it, has become an alternative investment decision class for everyone with deep pockets and a time horizon that stretches as much as freedom and independence.

Land is among our most valuable investments. In traditional societies it is a common good and cannot be alienated nor sold. In a modern day free market system land is a commodity that is desired and can be exchanged; its value and price are commanded by offer and demand and by the fundamental perception of potential benefits which can be derived from it. Land is finite in extent and is in increasing demand; and its value is expected to increase in the future.

Land is one of our most important investments. It encompasses surface, space, soil, provision of food and water, and a basis for urban and industrial development. Land stands for property and is a production factor besides labor and capital. Land embodies a lot more dimensions, such as homeland, place of ancestry, a necessity for realizing individual independence, and a basis for survival or prosperity. It is also an object that is desirable and desired by governments and interest groups.

Land-and obviously cultivable land-is finite in extent, and its quality is constantly under threat of degradation, primarily as a result of intensive cropping, soil mining and poor management, and population pressure (see Land Use, Land Cover and Soil Sciences).

Today, agricultural outputs have to procure food for double as many people in the world as there were a generation ago, and in fifty years it is predicted to be four times as many. This non-linear relationship that exists involving the growth in population and the growth in food resources was first noticed in 1798 by Rev. Robert Malthus.

The next generation is likely to see the highest population that the planet has ever experienced. This expanding demand for food cannot be indefinitely obtained from intensification of crop production and biotechnological progress, but requires also the extension of arable land. The general result is an increasing competition for land.

Features of Land Investment:

Investing in land is one of the most sound investment strategies available today and is a viable chance of most investors, both large and small.

Significant wealth has been created through Land Investment by individuals who understood the concept of buying and keeping investment land in the path of growth. When looking at investments for long-term capital growth potential, investments in land have returned dramatic rates of growth along with safe according to historic data and trends.

The reality is that land and particularly land investment has shown better average growth with less down side volatility. This makes land a solid investment for the conservative risk conscious investor.

Land values had increased by as much as eight fold over the past 20 years. What is interesting is that in the same time period property prices increased three fold, so as a wise investment land has actually performed comparatively a lot better than property.

.. Better average growth with less downside volatility.

.. Land is real Unlike shares, land is tangible, you can visit and see it.

.. An investment that is safe and flexible as you have the land to sell on at any time

.. Simple investment management in land development.

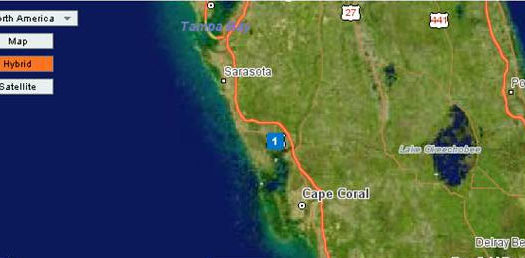

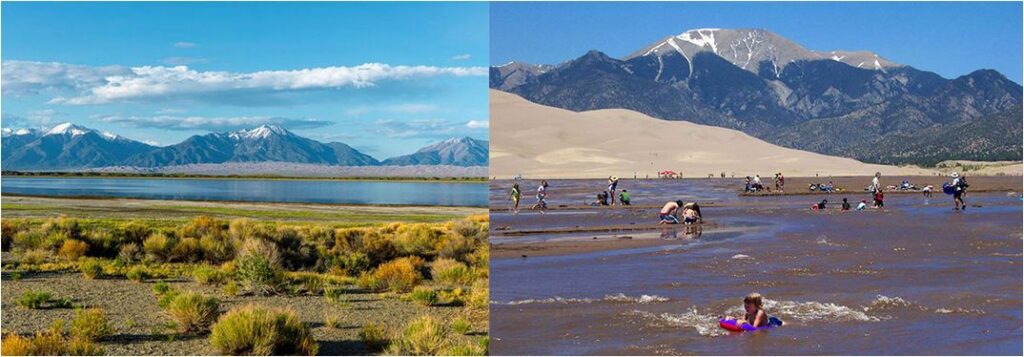

Best Places To Live in USA

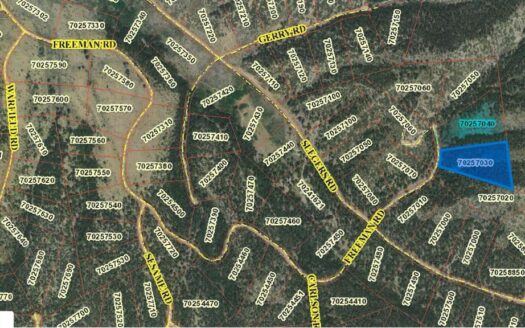

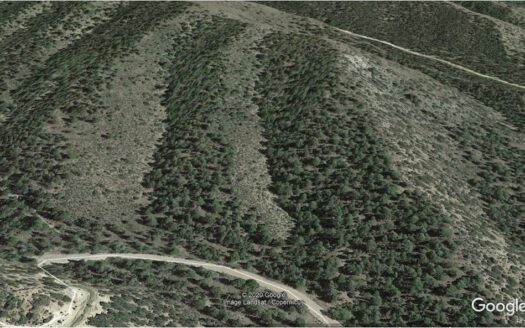

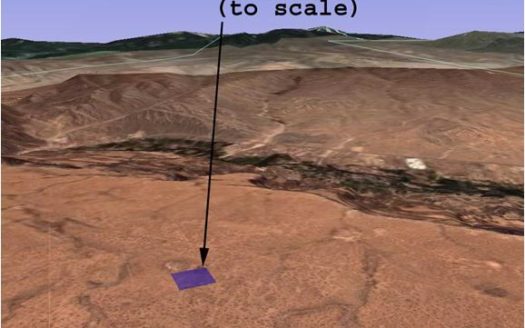

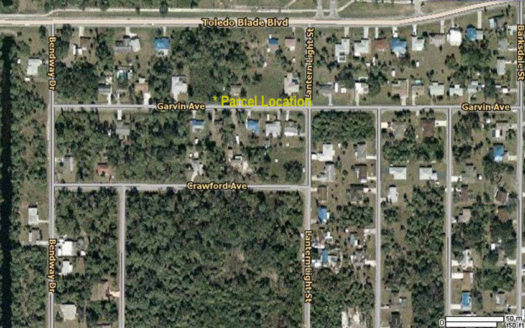

Selected areas to Buy affordable Land in America

Land can be a good investment decision for retirement, but not all land is created equal. If you were wise enough to buy Las Vegas? desert land before the gambling capital of the United States being erected, you made a lot of money. But under most situations, no one would recommend investing in desert land.

If smaller communities exist, the land can be utilized for farming, grazing, timber or other purposes. In other words, it provides a positive value. Land in the middle of Death Valley, on the other hand, is a high risk only for the most optimistic investors.

• Hunting Land: You can lease the land to hunters on a yearly or seasonal basis. Whilst hunting leases won?t net you as much as rental properties, there is zero upkeep, and you may make some money as your land accrues in value.

• Farm Leases: Nearly 40% of all farmland in the country is rented or leased. And the number of leases and space leases remains to be increasing. With farm leasing, you are able to lease the land for crop growing, or livestock and ranching. The price per acre varies greatly from state to state.